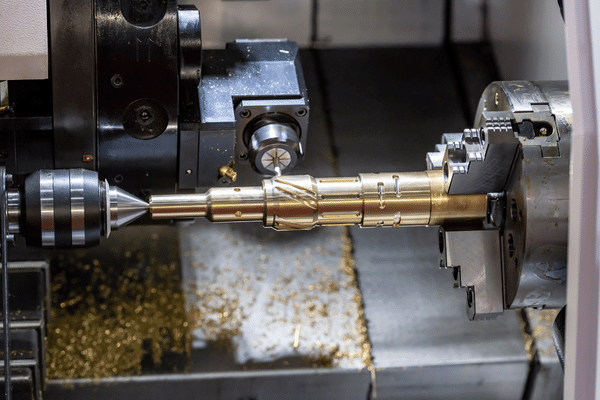

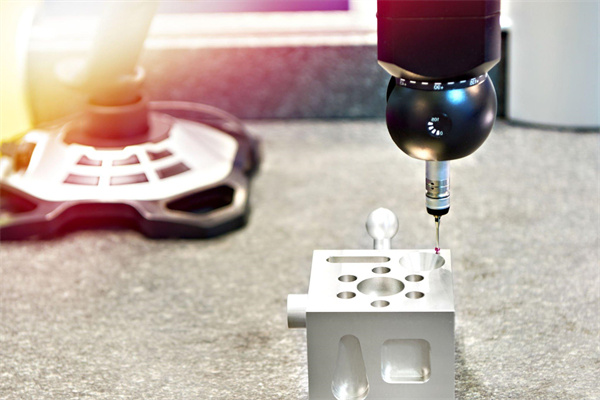

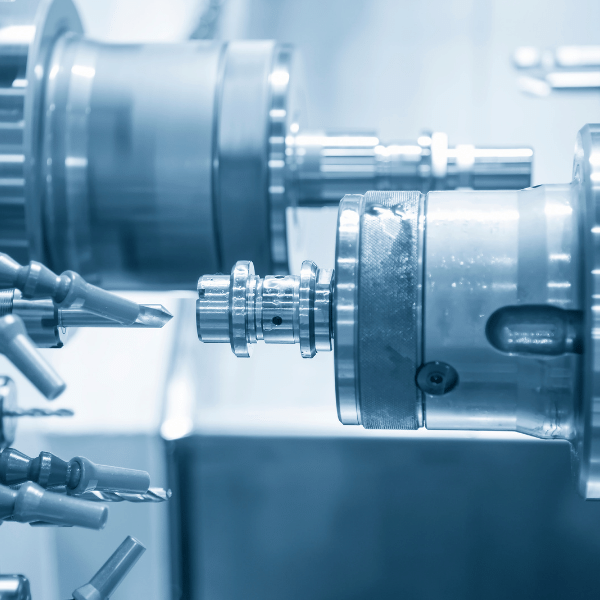

The Benefits of Financing a CNC Machine

Investing in a CNC machine is an important decision that requires careful consideration. It can be expensive, and you may wonder if it is worth the cost. One option to consider is financing your purchase through a loan. There are many benefits to obtaining a loan for a CNC machine, such as convenience, flexibility, and affordability. Let’s take a closer look at some of the advantages of financing a CNC machine purchase with a loan.

Convenience

Getting a loan for a CNC machine is incredibly convenient because it allows you to spread out your payments over time instead of having to pay for the entire cost upfront. This makes it easier to budget for the purchase and can help alleviate some of the financial strain associated with such an expense. Additionally, many lenders offer loans with flexible repayment terms so you can find an arrangement that works best for your budget and timeline.

Flexibility

When you finance your CNC machine purchase with a loan, you have more options when it comes to choosing what type of machine you want. You don’t have to settle for something less than ideal if finances are concerning you; instead, you can shop around until you find exactly what you need without worrying about whether or not it fits into your budget. Loans also give you more flexibility when it comes to timing; if something needs to get done quickly, but funds are tight, taking out a loan could be the answer.

Affordability

Obtaining financing for your CNC machine purchase will allow you to make smaller monthly payments which can be much more affordable than making one large payment upfront. Additionally, lenders often offer competitive interest rates, making financing even more affordable than paying cash upfront. Plus, in some cases, tax deductions may be available depending on what type of business you operate or how the machine will be used – another benefit that could potentially save money in the long run!

Financing your purchase of a CNC machine through a loan has many advantages including convenience, flexibility, and affordability. If you’re looking into purchasing one but are worried about costs or finding the right model for your needs, taking out a loan could be just the solution! Just remember to research and compare offers from different lenders before making any decisions regarding financing so that you get the most favorable deal possible!

Financing Options for CNC Machines

CNC machines have become indispensable tools in many industries, from manufacturing and engineering to design and research. If you are considering investing in a CNC machine for your business or personal use, you may wonder what financing options are available. Let’s explore some of the most common ways to finance the purchase of a CNC machine.

Personal Loans

Personal loans offer the flexibility to choose any CNC machine you want and from any vendor, but they typically have higher interest rates than other types of financing options. Depending on your creditworthiness, personal loans can either be secured by collateral or unsecured. The maximum loan amounts can vary but often reach up to $50,000.

Leasing Agreements

Leasing agreements are another option for financing a CNC machine. This type of loan enables you to pay off the equipment over time while avoiding having to take out a large lump sum loan with higher interest rates. Leasing agreements typically require lower down payments and less paperwork than other financing options. However, keep in mind that leasing agreements often restrict the types of CNC machines you can buy and where you can purchase them from.

SBA Loans

If your business qualifies for Small Business Administration (SBA) loans, then this is one of the best financing options for purchasing a CNC machine. SBA loans come with lower interest rates and longer repayment periods than personal loans, or leasing agreements, making them much more affordable in the long run. In addition, SBA loans offer more flexible terms so that you don’t have to worry about being locked into an expensive contract if something goes wrong with your purchase.

No matter which type of loan you choose to finance your purchase of a CNC machine, it’s important to compare all your options carefully before making a decision so that you get the best deal possible. Personal loans may provide more flexibility when it comes to selecting the right equipment, while leasing agreements may be better suited for those who don’t want to take out such a large lump sum loan at once.

And if your business qualifies for an SBA loan, then this is definitely worth looking into as well since it offers much lower interest rates and longer repayment periods than other financing options do. With so many choices available when it comes to funding a CNC machine purchase, there’s sure to be an option that fits both your needs and budget!

How to Secure Financing for Your CNC Machine Purchase

Buying a CNC machine can be an expensive endeavor. That’s why it’s important to understand your financing options before you make the purchase. With the right loan and payment plan, you can acquire the equipment you need without breaking the bank. Here are some tips for understanding the process of applying for a loan when buying a CNC machine.

Start with Your Credit Score

Your credit score is one of the primary factors lenders will consider when assessing your loan application, so it’s important to know what kind of shape your credit is in before applying. If you have an excellent score, lenders will see you as being more reliable and thus more likely to repay your loan on time. On the other hand, if your credit score is lower than average, lenders may still approve your loan but will likely charge a higher interest rate.

Understand Loan Terms

It’s important to thoroughly read through all of the terms associated with any potential loan before signing anything. Make sure that you understand all fees associated with obtaining a loan and any repayment guidelines that may be in place. In addition, make sure that you are comfortable with any early payment fees or late fees that may come into play if you decide to pay off early or miss a payment date. The last thing you want is to be stuck paying additional money for something that could have been avoided if only you had taken the time to read through all of the details associated with your loan agreement beforehand!

Shop Around for Lenders

When shopping around for a lender, make sure that they specialize in loans specifically designed for CNC machines and industrial equipment purchases. Some lenders offer better rates and terms than others, so it pays off to compare offers from several lenders before deciding which one is right for you. Additionally, look into whether or not there are any discounts available based on your business size or other qualifications such as number of years in business or annual revenue level, etc., as these can also help reduce costs overall when getting a loan for your CNC machine purchase.

Applying for a loan on your CNC machine purchase should not be taken lightly – but it doesn’t have to be intimidating either! By following these steps and doing some research ahead of time, you’ll find yourself in good shape when applying and securing financing for this major investment in your business’s future growth and success. Good luck!

Securing the Best Loan Amount for Your CNC Machine Purchase

If you’re in the market for a CNC machine, you’ll need to secure financing for your purchase. Estimating and securing the best loan amount possible can be tedious, but it doesn’t have to be. This blog post will provide all the tips and tricks you need to make sure you get the best loan amount when buying your CNC machine.

Do Your Research

Before you even begin looking for a loan, take time to research the different types of loans available and what kind of terms come with each option. It’s also important to consider how much money you need and if there are any other financing options that might be better suited for your needs. Knowing what is available and how much money you need before applying for a loan will help ensure you get an accurate estimate of how much you can borrow.

Compare Lenders

Once you understand what type of loan you want, it’s time to compare lenders. Lenders offer different loans with varying interest rates and repayment terms, so it’s important to shop around before settling on one lender. Make sure that the lender has good customer service and is willing to work with your specific needs. Additionally, check out online reviews from past customers to ensure they have a good reputation in terms of offering competitive rates and prompt payment processing.

Think About Your Credit Score Your credit score is one of the most important factors in determining whether or not a lender will approve your loan application, so it’s essential that you know where yours stands before applying for any loans. If your credit score isn’t as high as it should be, consider taking steps to improve it such as paying off any existing debt or disputing any errors on your credit report before applying for a loan. This will help increase your chances of being approved at better rates by potential lenders.

Also, remember that interest rates may vary depending on your credit score. Try to get an idea of what rate range lenders will likely offer based on your current credit situation before committing to any particular lender or loan product.

Understand Fees and Other Costs In addition to interest rates, other fees are associated with borrowing money such as origination fees or prepayment penalties which can add up quickly if not accounted for in advance. Be sure to understand all fees associated with a given loan so that there are no surprises later down the line when it comes time to pay back the borrowed funds.

Finally, make sure that all documents related to the loan process are reviewed thoroughly prior to signing anything–this includes reading through all details concerning repayment terms, interest rates, fees, and other costs associated with the loan itself to ensure everything is clear prior to signing anything binding yourself legally (and financially) into a repayment agreement with the lender(s).

Estimating and securing the best loan amount possible when purchasing a CNC machine requires some research upfront. Still, it is well worth it to save yourself time (and money) down the line by getting the best deal possible on the financing side of things! With the above tips outlined here today–from researching different types of loans available through understanding fees/costs associated with those loans–you’ll be able to find the right financing fit & secure the best loan amount possible make sure to stay within budget while still able purchase necessary machinery needed meet production goals! Good luck shopping!

Making Repayment Easier with CNC Machines

Are you looking to purchase a CNC machine but feeling overwhelmed with the repayment process? Several tips and tricks can help you make repayment easier. From understanding the different payment options to researching financing requirements, these tips will make the process much more straightforward.

Understand Your Payment Options: This is a critical step in purchasing a CNC machine. You should take some time to understand what payment options are available to you. Do you want to pay for the machine outright or use a financing option? It’s important to know your budget and if you have enough money saved up for the purchase. Additionally, look into any financing deals that may be available, as they could provide more flexibility when it comes to repayment terms.

Research Financing Requirements: Once you’ve decided on a payment option, it’s time to look into the financing requirements of your chosen supplier. In most cases, suppliers will require an upfront deposit before allowing you to finance the remainder of the purchase price. It’s also worth checking what type of credit score they need from potential buyers; this will give you an idea of whether or not you are eligible for financing. Additionally, familiarize yourself with any other paperwork that may be needed, such as ID and proof of income documents.

Compare Rates and Terms: Once you’ve identified what paperwork your chosen supplier requires, it’s time to compare their rates and terms with other providers to get the best possible deal. Make sure that all fees are clearly outlined in each offer so that there is no confusion over additional costs later down the line. Also, keep in mind that interest rates vary significantly between lenders, so shop for the lowest possible rate!

Purchasing a CNC machine can be complex, but proper research and preparation can become much simpler. Knowing your payment options and researching financing requirements are two essential steps when making repayment easier. Additionally, comparing rates and terms between different providers can help ensure that you get the best possible deal on your new investment! With these tips in mind, buying your new CNC machine won’t be overwhelming anymore!